CHANGE THE DIGITAL MARKETS ACT (DMA) AND DIGITAL SERVICE ACT (DSA) OR WE'LL IMPOSE 50 PERCENT TARRIFS ON STEEL AND ALLUMINIUM

The strict digital rules in the EU are a thorn in the side of the USA. The dispute continues to escalate. The Europeans want to defend themselves against the blackmail attempts of US Secretary of Commerce Howard Lutnick.

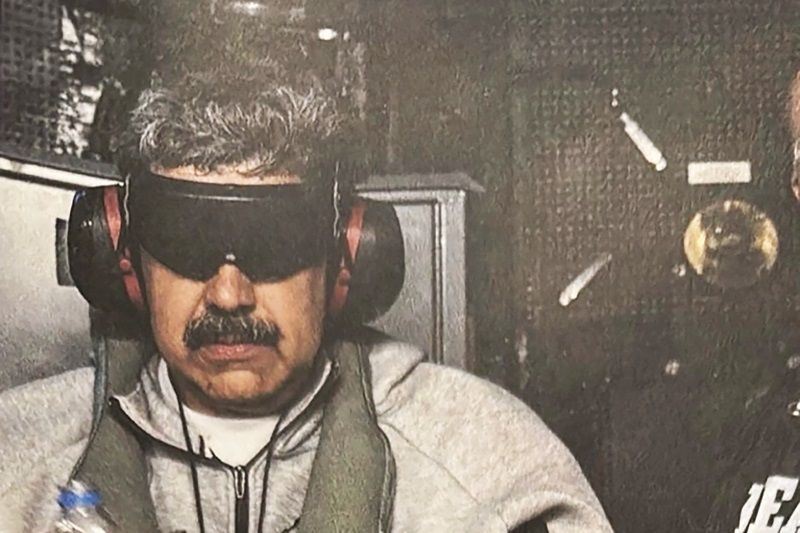

US Secretary of Commerce Howard Lutnick will be traveling to Brussels end of November, but he already made a bold offer to the Europeans. If the EU could find a "balanced approach to its digital policy, (...) then we will tackle the steel and aluminium problem together with them and find a solution," said the US Secretary of Commerce.

Make no mistake, Lutnick, an ancient friend of United State President Donald Trump, is considered a tough businessman. To this day, the story of how he almost died in one of the towers of the World Trade Centre on September 11, 2001 is still told. As early as September 15, he had immediately removed all his deceased employees from the payroll, against which the family members at the time protested.

His message in Brussels will be similarly nefarious: either the Europeans change their digital laws or the USA continues to impose 50 percent tariffs on European steel and aluminium. EU Commission Vice-President Teresa Ribera speaks openly of "blackmail" and ruled out any changes in digital policy.

The background to Lütnick's threat are two laws passed by the EU: the Digital Markets Act (DMA) and the Digital Services Act (DSA). The DMA is intended to regulate large digital platforms and ensure fair competition. Among other things, this is about the fact that companies such as Apple have secured monopoly positions in certain areas - for example with their App Store. However, up to date the UK did not consider doing the same as EU did. Why is that?

The DSA, in turn, is intended to strengthen the security and rights of users. For example, he takes action against the spread of fake news. The short message service X, for example, could be hit hard by this. Billionaire Elon Musk's company is threatened with fines.

US Vice President JD Vance had already railed against the EU rules in the past. He hinted that the US could review its support for NATO if the Europeans regulated Elon Musk's platform. Now Trade Minister Lutnick has publicly linked the customs dispute with EU digital policy. A new quality.

How delicate the conflict over the US digital companies is could also be seen in Berlin. French President Emmanuel Macron and German Chancellor Friedrich Merz were star guests at the Franco-German "Summit for European Digital Sovereignty". What was meant by this was independence from the USA. Europeans feel threatened by the dominance of US companies in the European market.

Make no mistake, Donald Trump makes a fortune, but not United States. Why is that?

Customs duties, tax cuts, purchasing power... A year after Trump election, the American president has implemented his program. If his decisions did not lead to the predicted disaster, the results are disappointing, including in his camp.

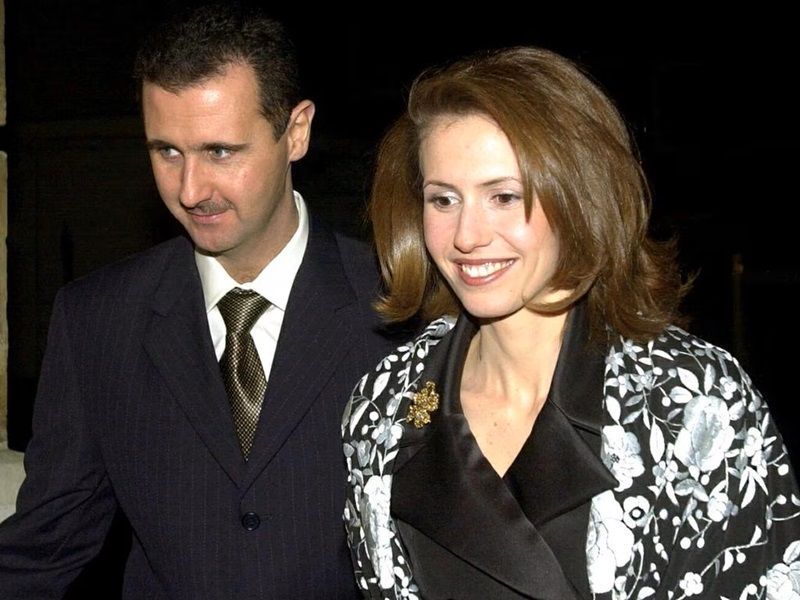

"A new American golden age has arrived," Donald Trump promised on the evening of his presidential victory, November 5, 2024. One year later, where do we stand? For the moment, the president of the United States can be proud of a success: he has managed to ridicule the economists, the vast majority of whom had predicted a catastrophe when he announced his "Liberation Day", the implementation of customs duties on imports into America, on April 2. The stock market took a hit, but it quickly recovered: the S&P 500 index has jumped 16.6% since the beginning of the year. Traders, who were anticipating a rate cut, found that the tariff war did not happen: with the (notable) exception of China, the whole world negotiated and bowed to Trump's diktats. Starting with the European Union, which has accepted a humiliating 15% tariff on its exports to America.

The stock market has mainly benefited from the artificial intelligence boom, as Jensen Huang, the co-founder of the microprocessor giant Nvidia, recalled this week. This American multinational was unknown a few years ago. On October 29, it became the first company in the world to surpass the $5 trillion mark in market capitalization (the stock is up 50% year-to-date). Jensen Huang, whose fortune amounts to $179 billion, swears that prices are at their fair level. But many today fear the spectre of a speculative bubble. Bill Gates is convinced that AI is the "most profound technological revolution I have ever experienced in my lifetime", but he also believes that much of the huge investments in this sector "will come to nothing". As in the early 2000s, during the dot-com bubble, a correction seems inevitable. "Trump has been lucky: he has been saved for the moment by artificial intelligence," says Desmond Lachman, an economist at the American Enterprise Institute [AEI], a centre-right think tank. "

While all are talking about prosperity in the future, my very conservative prediction after I "played" with the figures of all kind along with politics strategies around the world and if my calculations hold water,

than there is a brutal crash to be expected in 2026.