OPEN LETTER to HM TREASURY and THE FINANCIAL OMBUDSMAN UK

Ms Emma Reynolds

Economic Secretary to the Treasury

HM Government UK

The Financial Ombudsman UK

Dear Sir/Madam

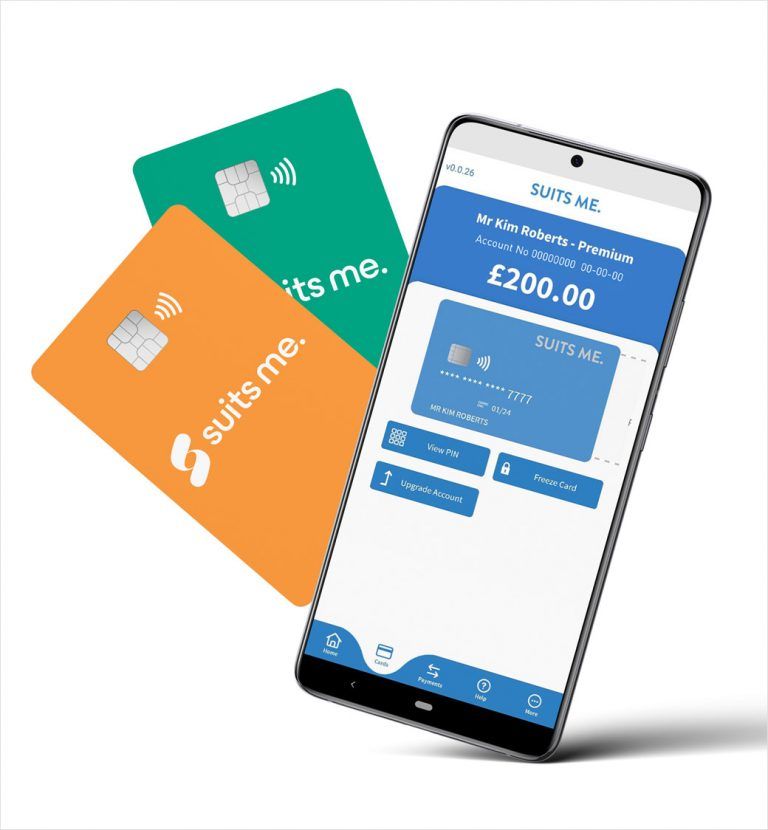

Suits Me – ambiguous status and non-compliance with FCA expectations and regulations.

I received over hundreds of letters and mails from people in the United Kingdom who applied for the above accounts and they stressed how they been “crossed”. I cannot talk, even less judge something what I did not come across with, therefore, I simply applied for the account myself: For the personal account and the business account which both would cover what people were telling me in their post and mails.

I write to express my deep concern about the operating behaviours of this company who I believe misrepresent their services and are non-compliant with financial services regulation. I have complained to them as my account was closed with no specific reason given for the closure.

The concerns I would particularly like to highlight include:

1. Service is not covered by UK Financial Ombudsman.

Having submitted my complaint to the organisation about closing my bank account with no specific reason given for the closure, I have been informed that if I want to take this matter further then I need to contact the card issuer: IDT financial services Ltd, PO Box 1374 1 Montarik Building, 3 Bedlam Court, Gibraltar.

If I have then exhausted my complaints process with IDT financial services and I remain unhappy I am advised to contact the Gibraltar financial services commission PO Box 940, Suite 3, ground floor, Atlantic suites, Europa Avenue, Gibraltar.

At no stage when I requested this bank account was I informed that I was dealing with an institution that was not covered by the UK financial ombudsman; I believe their website is misleading in this regard.

What the Suits Me are saying was:

Unfortunately, we are not at liberty to or required to provide any additional details regarding your account block, and we would only block/close an account if absolutely necessary. Please rest assured that we are committed to adhering to financial regulations, and our processes may differ from those of traditional banks as we operate as an online account solution. It is important to note that our terms and conditions at section 16 state that the suspension of account usage is permitted and may be necessary if we identify valid grounds for such action. This is in accordance with regulatory guidelines aimed at ensuring the safety of all parties involved, including our customers.

The section does not give ideas or even less any answer about valid grounds.

2. GDPR concerns.

Their correspondence advises me that Suits Me is registered with the Information Commissioners office within the UK under registration reference number ZA237140. Suits Me has collected a significant amount of my personal data in order to open a bank account.

I find it baffling that they could be compliant with the UK information Commissioners office, but at the same time they cannot take responsibility for their services within the UK as their supplier is seemingly based in Gibraltar.

I am now aware that my data has obviously been passed on to this Gibraltar organisation – but at no time did I knowingly give my permission for that.

3. Unusual working practice

With the correspondence, I am advised “we are not at liberty to or required to provide any additional details regarding your account block, and we would only block/close an account if absolutely necessary. Please rest assured that we are committed to adhering to financial regulations, and our processes may differ from those of traditional banks as we operate as an online account solution”.

This comes across as furiously unreasonable, weird and deceptive. We are all aware of the high-profile court case that Nigel Farage bought against Coutts bank, at which point they were forced to identify their reasons for closing his account and their chief executive lost her job. It seems very bizarre in 2025 that a financial institution does not have to account for its behaviours to its customers.

4. Misleading website

When is a bank not a bank?

Seemingly if you are “An award winning alternative to high street banks”.

Is it reasonable to make a statement in the small print that “Suits Me is not a bank” to then promote yourself as a bank, act like a bank, win awards from the British Bank Awards – including one for Best Current Account provider – and then sidestep all UK banking legislation and compliance requirements?

It is even more concerned issue because they advertise that they are replacement to all who can not have regular bank account for the reasons as bankruptcy, CCJ’s, Debt Relief Order, Debt Management and other such issues

not even to mention that they are collecting money from most vulnerable people and there is no guarantee for them to get whatever repayment in case if something goes wrong like the UK banks guarantee their customers £85,000 for such cases.

I assume that Suits Me speculate with money generated with brokers from currency up to properties and more therefore, all not really safe environment as you never know when one of that can collapse.

I feel very mislead by Suit Me and unhappy about the way they are dealing with all the accounts not to mention including with my personal and business account, which has caused significant distress to hundreds of applicants and even me.

I would welcome your investigation of these concerns.

Thank you.

Your Faithfully

ZDENKO KOS MSC MEc BScEcon(Hons) MBA

For and on behalf of over hundreds applicants including myself

Ps:

Up to 18th June 2025 a staggering 1,627 mails and letters being received from readers of our blog who has experienced same or similar issues with the Suits Me card provider either for personal or business account.